Working with a contract manufacturer is a tricky business – especially if the factory is located on the other side of the world. You have dozens of elements you need to manage that could make or break the quality and saleability of your products, all while you try to keep costs down. That’s why we’ve spent more than a decade compiling the data and investigating the real costs and benefits of integrating product inspection and auditing into your supply chain. Are inspections and audits worth the cost in the long run? And what quantifiable value do these quality measures add to buyers like you?

In this article, we provide the findings and figures to answer these questions.

The Cost Factors

Every decision has a ripple effect down the line that can eventually trickle down to the buyer receiving an unsellable product. The decision at hand is whether the cost of quality inspection is worth it in the end, or if it is unnecessary. Let’s start off by looking at the costs of QC, and then the costs you risk if something goes wrong.

Inspection and Auditing Fees

Most new buyers concentrate solely on the initial cost of quality control services and are hesitant to add it to their projected costs from suppliers. Many buyers decide not to invest in QC services, which is a perfectly normal reaction for the novice or small time buyer.

Projected Risk Costs

The following are the costs and risks you assume without the use of any third-party quality inspection:

- Charge-backs – Charge-backs from retailers to brands and importers for issues related to product quality, labeling, late shipments, etc.

- Delays – Other than charge-backs from retailers, the cost of delays include:

- Cancelled orders from your clients

- Lost sales; and

- Cost of air freight/expedited freight

- Reputation – Although the hardest factor to quantify, the potential damage to a brand’s reputation is likely the most costly threat to delivering poor quality or not delivering on time. This includes unrealized sales from lost accounts.

- Compliance Issues – Tying into reputation as well, retailers will often disqualify sources that do not comply with established humanitarian standards. Furthermore, brands and importers do not want to end up the focus of negative publicity due to child-labor, hazardous conditions and other issues.

- Quality Issues, including:

- Re-work cost upon receipt

- Cost of unsalable product

- Product recalls; and

- Customer returns/dissatisfaction

- Overseas Trips – Sending staff overseas to meet with suppliers can be costly both in terms of the actual financial cost and the time lost while abroad. We calculate the total cost of a company’s staff traveling to Asia to solve issues based on both the cost of the trip and the time-cost of the employees that must travel.

Case Study – First Hand Look

Now we turn to a Case Study to detail the problems and extra costs a U. S. buyer encountered through the experience of contract manufacturing in China.

The Brand

This study of QC costs involves a brand of kitchen items that is popular in nearly every retail outlet in the U.S. and also has significant sales in Europe and Australia. Their estimated total sales revenue is 95 million USD, and ap proximately 90 percent of the product is produced in China. The company buys an estimated 30+ million USD worth of product from China each year.

proximately 90 percent of the product is produced in China. The company buys an estimated 30+ million USD worth of product from China each year.

InTouch’s involvement with the brand in question has spanned a total of 7 years.

Prior to engaging with InTouch, the brand in question did not perform product inspections of its imported merchandise until the goods were received in the United States. In some cases, the goods were delivered directly to the retailer, their client, without any QC inspection at all. Additionally, the company did not perform any quality or social compliance auditing of their factories in China.

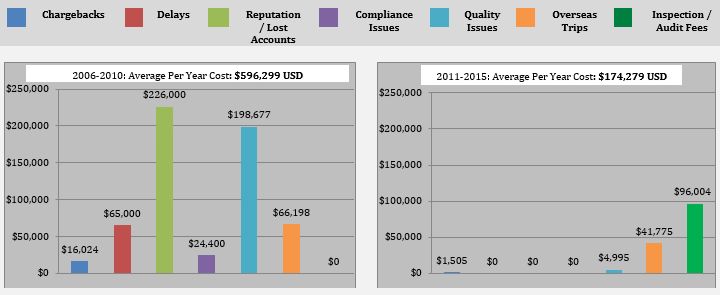

Looking at their costs from 2006 to 2010 – the time prior to starting inspections and audits – we determined a few key contributing issues:

Issues

Rework in the United States

Over a 5-year period, the brand needed to carry out product re-work in the U.S. an average of four times per year. On average, the cost of this re-work, including labor and materials, was $18,201 USD each time. On two occasions, the cost of reworking exceeded $60,000 USD. Re-work was required to correct issues such as:

- Mislabeling

- Incorrect packaging

- Incorrect material type

- Incorrect shape

- Incorrect item

- Scratches and other visual imperfections

- Poor coating on product; and

- Incorrect logo on product

Lost Accounts

Whilst the brand’s sales had grown considerably overall during the 5-year period, it lost one key retail account due to inability to meet delivery schedules for three consecutive years. Their inability to meet delivery schedules was due to one poor performing Chinese factory. The supplier repeatedly delayed production, delivered out-of-spec product and communicated poorly. The U.S. company suffered a total profit loss averaging $226,000 USD per year after losing the primary retail account.

Compliance Issues

The same Chinese factory mentioned above, that from the Wenzhou area, was also disqualified from producing for a separate account due to repeated fire-safety violations uncovered during the retailer’s audits. The total cost associated with identifying a new supplier and switching production over was $122,000 USD, incurred in 2010. This cost included two overseas trips by U.S. purchasing executives.

InTouch Engagement

In early 2011, the cookware brand mentioned engaged InTouch on two fronts. Product inspections were performed against the brand’s quality criteria and  requirements. The other initiative was to set up a social compliance monitoring program to ensure that the contract manufacturers were meeting the minimum established standards for the company and its retail clients.

requirements. The other initiative was to set up a social compliance monitoring program to ensure that the contract manufacturers were meeting the minimum established standards for the company and its retail clients.

From 2011 through 2015, InTouch performed an average 276 inspections per year on behalf of the brand at 16 different suppliers. While there was some initial hesitation from the Chinese suppliers, reservations soon gave way to relief when there was finally a clear set of quality standards being applied. The suppliers were able to see how inspections and audits were preventing issues discovered when the goods were received in the U.S.

The below charts document the dramatic effect that implementing a simple inspection and audit program had on the total cost of quality. Involvement of an independent party for these programs reduced the direct costs of quality and increased transparency of the supply chain. Moreover, the introduction of the QC partner also meant one less annual trip to Asia for staff was required, saving an additional ~$20,000 USD per year.

Conclusion

Many first-time buyers approach quality control by assuming the factory will take responsibility for it. They often feel the factory should have internal QC staff capable of ensuring the product meets expectations before shipping. These buyers view third-party QC as a redundant, and therefore unnecessary, expenditure.

But the fact is quality control actually saves buyers and importers a considerable sum that might otherwise be incurred in the form of quality issues, charge-backs and delays. Lack of oversight from a trusted QC company can also lead to compliance issues, damage to the brand’s reputation and multiple trips by company staff to meet with suppliers face-to-face to work through stubborn manufacturing issues.

The example of the case study above is quite telling. The costs incurred by proper inspection and auditing services were insignificant compared to the price paid for lack of transparency prior to InTouch’s engagement. This story demonstrates that the level of security and transparency that performing such services adds to the supply-chain is invaluable to the businesses that employ them.